17+ Immediate annuity

What Is an Immediate Annuity. Ad Americas 1 Independently Rated Source for Annuities.

Bajaj Allianz Life Guaranteed Pension Review Goodmoneying

A single-premium immediate annuity SPIA is a retirement insurance plan most often used for an immediate income stream.

. On the other hand. Payments start one month after your annuity is. An immediate annuity can provide you with predictable income during retirement that you can use for essential living expenses.

Learn More On AARP. Ad Compare Annuity Income Quotes from over 25 Top Companies. Payouts can begin immediately.

Payments generated from this type of. The immediate annuity plan is the most basic form of annuity in the Indian market yet it is laced with a host of features to benefit you. For people nearing retirement age immediate annuities can be a helpful supplement to other retirement savings vehicles.

They might have existing income sources such as Social. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. 10000 minimum These annuities have annual fees ranging from 01 with an initial investment of 1 million or more up to 19 plus.

You start by putting in money you. What Immediate Annuities Offer Annuities are a form of insurance and insurance is a risk management toolnot an investment. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now.

Ad Immediate annuities are often a complex retirement investment product. Set up as an insurance plan an immediate annuity is funded with an initial amount and then makes payouts. With an immediate annuity the type that distributes to you a portion of your principal plus interest each year during your lifetime in the end all the principal will have been.

Little-Know Tips You Absolutely Must Know Before Buying An Annuity. Immediate annuities let you begin receiving payments immediately after giving your funds to the insurance company. In most cases the contract begins delivering steady income within 30 days of the investor buying it.

Unsure if immediate annuities are a good investment. Essentially the way an immediate life annuity works is by paying a lump sum of money in exchange for an income stream based on a lifetime repetitive income stream. You purchase it with one payment and may begin receiving income payments right away within 12 months.

A consumer provides a single lump sum payment to an insurance. Fixed annuities available at Fidelity are issued by. A Fixed Annuity May Provide A Very Secure Tax-Deferred Investment.

Life Annuity with Guaranteed Periodpayments for as long as you live but no less than a specified minimum. You might consider this type of annuity if you received a large sum of money. Read this guide to compare.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. I still have a balanced portfolio. Immediate fixed income annuities.

When you buy an immediate annuity you are. In addition you also have the option of adding a certain period to an. An immediate income annuity sometimes also called an instant annuity is a type of annuity where the payouts begin very soon after you buy itusually within a year.

One immediate annuity can provide guaranteed lifetime income for two people for example both you and your spouse. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Annuity guarantees are subject to the claims-paying ability of the issuing insurance company.

You pay the lump-sum. Life Annuitypayments for as long as you live. Immediate annuities are for people who want a steady guaranteed source of income to live off of in retirement.

An immediate annuity is simple and consumer-friendly. Pick the payment type you prefer. The three types of immediate.

Immediate annuities are an option if youre close to retirement and need a steady income. It is distinct from a. Ad A Calculator To Help You Decide How A Fixed Annuity Might Fit Into Your Retirement Plan.

With an immediate annuity you can provide guaranteed. I will be taking monthly disbursements from my IRA. Immediate annuities guarantee an income stream within a month of purchase without an accumulation period.

Get Personalized Rates from Our Database of Over 40 A Rated Annuity Providers. And in all cases within 13 months after purchase. I am turning 70 in June and retiring as of July 1.

Some of the key ones are.

Bajaj Allianz Life Guaranteed Pension Review Goodmoneying

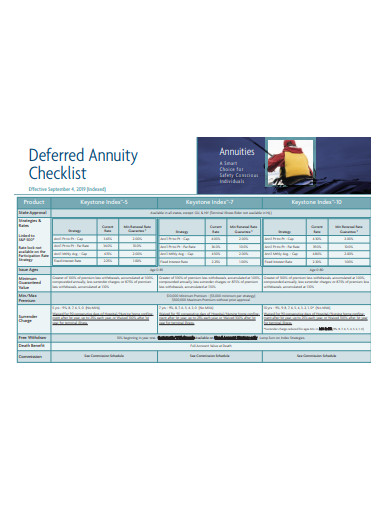

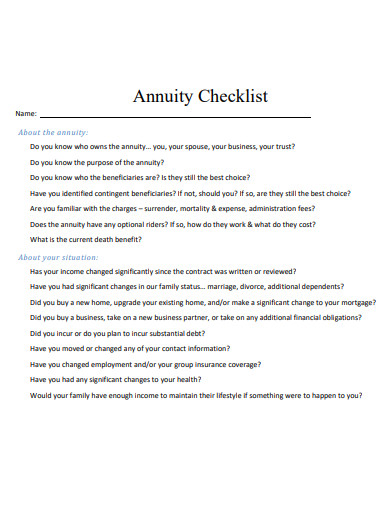

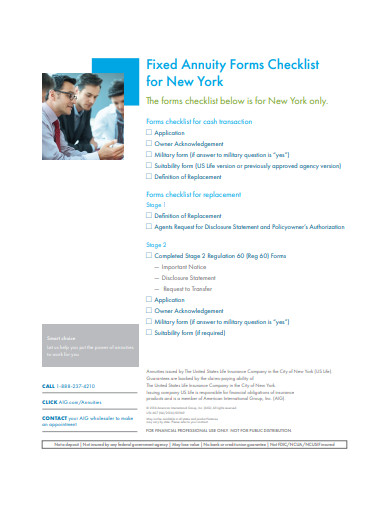

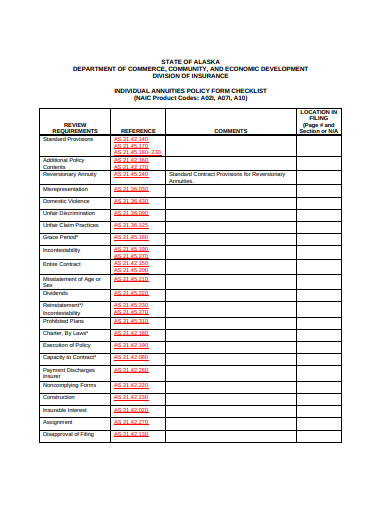

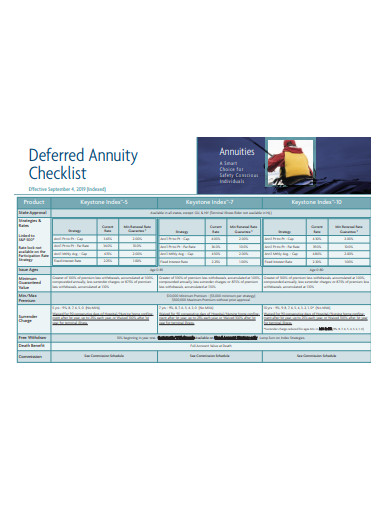

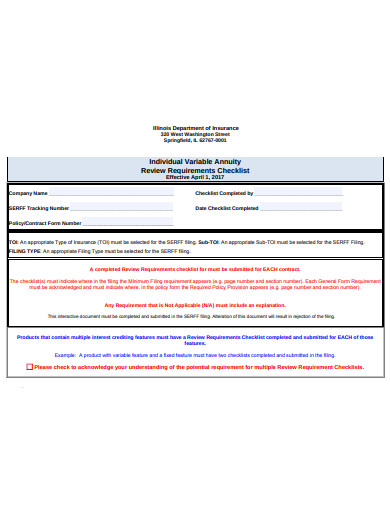

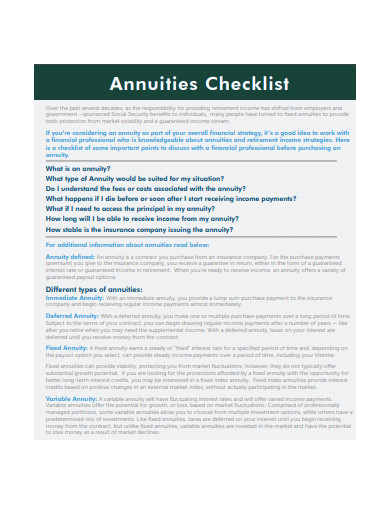

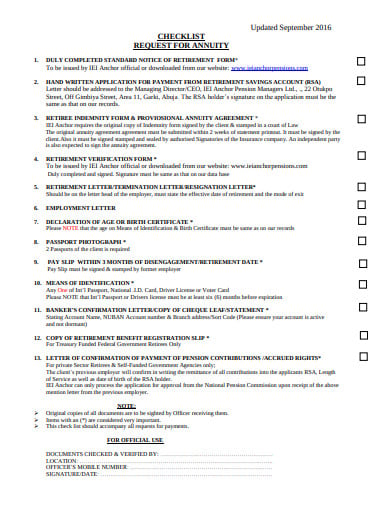

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

Difference Between Immediate Annuity And Deferred Annuity Plans How To Plan Annuity Single Premium

Hdfc Pension Plan Super Pension Plus Should You Buy For Retirement

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

Pin On Financial Literacy

Hdfc Life New Immediate Annuity Plan Review Goodmoneying

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

Hdfc Life New Immediate Annuity Plan Review Goodmoneying

Hdfc Life New Immediate Annuity Plan Review Goodmoneying

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

Hdfc Life New Immediate Annuity Plan Review Goodmoneying

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

Hdfc Life New Immediate Annuity Plan Review Goodmoneying

Indexed Annuity Returns Rates And Examples Annuity Health Insurance Policies Index